Corporate cryptocurrency dictatorship: How tech giants are seizing financial freedom through blockchain

The morning that will change the understanding of money

Imagine your morning coffee with the news: “Circle has frozen 10,000 wallets. The funds are non-refundable. The reasons are not disclosed.” The next day you read: “The U.S. Congress has passed a law granting corporations the right to destroy citizens’ digital assets without trial.” Third day: “Stripe launches its own blockchain with full control over user transactions.”

Science fiction? No. The reality of 2024–2025, which is unfolding right now.

The three largest technology corporations — Circle, Stripe, and U.S. lawmakers — are simultaneously launching projects that fundamentally change the nature of digital money. But what they present as innovations and solutions to the problems of the crypto industry is in fact a coordinated attack on financial autonomy.

Anatomy of the takeover: how technologies of freedom turn into tools of control

To understand the scale of what is happening, we need to start with the basics. Blockchain technology was originally created as a way to conduct financial transactions without intermediaries — banks, payment systems, government regulators. The idea was simple: mathematical algorithms replace human institutions, making the financial system fairer and more open to everyone.

But corporations have found a way to reverse this logic. Instead of competing with blockchain technologies or banning their use, they are creating pseudo-decentralized systems that look like innovations but function as tools of total control.

USDC as the Fed’s Trojan horse: a mechanism of covert control

Let’s start with an analysis of Circle’s Arc blockchain, which uses a fundamentally new approach to user control. Arc uses USDC as “gas” — the fuel for all operations on the network. This may seem like a technical solution, but in reality, it creates a direct mechanism of control by the Federal Reserve over all transactions on the network.

Let’s break down this mechanism step by step. In traditional blockchains like Ethereum or Bitcoin, native tokens — ETH or BTC — are used to pay for transactions. These tokens are created through mathematical processes and are not controlled by any central organization. But Arc does something fundamentally different: it requires the use of USDC — a stablecoin fully controlled by the American company Circle.

Each USDC token exists only because Circle holds an equivalent amount in U.S. dollars in American banks or U.S. government bonds. According to the GENIUS Act — a U.S. law regulating stablecoins — more than 65% of USDC reserves must be held in U.S. Treasury bills. This creates a direct link between every transaction on Arc and the financial policy of the Federal Reserve.

Think about this chain of dependencies: to use Arc, you need USDC. For USDC to exist, Circle must buy U.S. government bonds. For those bonds to have value, the American financial system must function under the control of the Federal Reserve. Thus, every operation on the “decentralized” Arc blockchain effectively requires approval from the American financial system.

Three levers of total control

The Federal Reserve receives three powerful instruments of influence over Arc and similar systems through this architecture.

First lever — liquidity control. When the Fed raises interest rates, it becomes more expensive to hold reserves to support USDC. This works as if the government could increase the cost of fuel for all cars of a certain brand — owners will start driving less or switch to other transport. Circle may be forced to reduce the issuance of new USDC or increase fees for its use, which directly affects users’ ability to make transactions on Arc.

Second lever — direct influence on the cost of transactions. Since all fees on Arc are paid in USDC, changes in the Treasury bond market directly affect the cost of using the network. The Fed can de facto control the “tax” on all operations in Arc, without even making special decisions about blockchain technologies. It is enough to change the conditions in the government bond market.

Third lever — control through reserve requirements. The GENIUS Act allows regulators to determine which assets can be used as reserves for stablecoins. The Fed can limit the list of permitted assets, effectively controlling the ability of networks like Arc to function. If regulators decide that certain types of Treasury bonds are no longer suitable for reserves, Circle will be forced to restructure the entire USDC backing system.

Scale of influence: stablecoins as a new form of government debt

To understand the scale of this situation, let’s look at the numbers that show how deeply the stablecoin industry is already integrated into the American financial system.

Circle and Tether — the two largest stablecoin issuers — have already become the 18th largest holders of U.S. government debt, surpassing entire countries like Germany. According to forecasts by ARK Invest, by 2030 stablecoin issuers may hold more than 660 billion dollars in U.S. Treasury bonds — almost as much as China holds.

This creates a dangerous feedback loop. Every new USDC token requires the purchase of additional U.S. bonds, creating automatic demand for U.S. government debt. The American government gets a guaranteed buyer of its debt, and the Federal Reserve receives a lever of influence over the entire crypto ecosystem through its control of the bond market.

A study by the Bank for International Settlements shows that an inflow of 3.5 billion dollars into stablecoins reduces the yield on three-month Treasury bills by 2–2.5 basis points. The reverse process — a massive outflow from stablecoins — could destabilize both the stablecoin market and the government bond market at the same time. The Fed gains the ability to manipulate the Treasury bond market to influence the cost of maintaining USDC’s peg to the dollar, effectively targeting specific blockchains through monetary policy.

Surveillance system: turning blockchains into tools of monitoring

The Arc architecture with USDC creates unprecedented opportunities for monitoring user financial activity. Since every transaction requires USDC to pay for gas, all activities on the network become visible through Circle’s compliance system.

This functions as an automatic enforcement system for financial legislation. Circle already applies strict wallet-freezing policies in accordance with U.S. sanctions, and these mechanisms automatically extend to all transactions on Arc. Imagine a system where, for every purchase in a store, you must use special money issued by a bank that tracks every expense and has the right to freeze your account at any moment.

The Federal Reserve receives a detailed picture of all economic activity on Arc through flows in the Treasury bond market and Circle’s reserve management. Every large transaction on Arc creates corresponding movements in USDC reserves, which are reflected in the U.S. government bond market. This gives American regulators real-time economic intelligence about blockchain activity.

Architecture of deception: false privacy as a tool of control

Circle positions Arc as a breakthrough in private payments, but the system’s architecture tells a completely different story. Imagine a bank that encrypts the amounts on your checks but leaves the senders and recipients visible to everyone. That’s exactly how Arc works — the system hides transaction amounts, but all addresses remain public.

The key feature of Arc is called “view keys” — special cryptographic keys that provide full access to encrypted data. Circle presents them as a tool for optional transparency to comply with regulatory requirements, but in practice, view keys function as master keys for total surveillance.

Unlike truly private systems like Monero, where law enforcement must break through protection from the outside, Arc provides VIP access to data through official channels. Moreover, all “institutional clients” of Arc by default see the transactions of their users to comply with anti-money laundering requirements. This means your bank, exchange, or payment service automatically receives full information about your financial operations — not only through Arc, but also about all related transactions in other systems.

Pseudodecentralization: how corporations imitate blockchain

Traditional blockchains reach consensus through cryptographic mechanisms, where decisions are made by mathematical algorithms rather than human institutions. Arc radically changes this logic by using a “limited set of geographically distributed licensed known institutions as validators.”

Translating from corporate jargon into plain language: Circle selects several large banks and financial corporations that will make decisions about the validity of transactions. These validators have “public names” and obligations to “adhere to accountability standards” — meaning they are known to regulators and comply with their requirements.

It is critically important to understand that such a system allows validators to “reverse transactions through dispute protocols.” Imagine a court where the judges are simultaneously the prosecutors, and the defendants have no right to defense. Any transaction in Arc can potentially be reversed, frozen, or censored by a decision of the consortium of validators, who have already agreed in advance to cooperate with the authorities.

Tempo by Stripe: full vertical integration of control

Stripe takes this concept even further through its blockchain, Tempo. Unlike Arc, which at least creates the appearance of decentralization through multiple validators, Tempo represents a fully centralized system disguised as blockchain innovation.

Stripe operates all the servers processing Tempo transactions. The company defines validation rules, sets fees, and controls payment processing speed. What is critically important — Stripe can instantly change any system parameters or completely disable access to it without prior notice to users.

Integration as a dependency trap

Tempo creates a vertically integrated ecosystem where Stripe controls the entire financial technology stack — from user wallets to blockchain infrastructure. For businesses, this means unmatched efficiency and cost savings. For users — complete dependence on the decisions of a single corporation.

Imagine the situation: your business uses Stripe wallets, processes payments via Tempo, stores funds in stablecoins issued by Stripe partners. If the company decides to block your account, you simultaneously lose access to your funds, the ability to accept payments, and the ability to transfer assets to other systems. This is not just an account freeze — it is financial isolation.

Real cases already show how this works today. Users are widely reporting the same scenario: “Stripe suddenly labeled us as high risk and blocked all functions. We provided all requested documentation, explained the nature of our business, but the decision was never reviewed. The funds were not returned even after six months.”

GENIUS Act: legal formalization of corporate dictatorship

The GENIUS Act does not merely regulate stablecoins — it creates a legal foundation for corporate control over digital assets. The law introduces the concept of a “lawful order” — judicial or administrative directives that require stablecoin issuers to “seize, freeze, burn, or prevent the transfer” of tokens.

The key requirement of the law is that issuers must initially design their systems with the technical capability to instantly destroy or freeze any tokens. This is not an emergency measure for exceptional cases — it is a fundamental architectural requirement for obtaining a license to issue stablecoins.

What is especially alarming is that the GENIUS Act contains no guarantees for the restoration of frozen or destroyed assets. The law does not establish compensation procedures for users whose funds were frozen by mistake. It does not define time frames for unfreezing accounts. Corporations are granted the right to destroy digital assets permanently — and this decision may be irreversible.

Turning financial oversight into an automated control system

Arc, Tempo, and the requirements of the GENIUS Act create the technical infrastructure for automated financial oversight. In the traditional banking system, suspicious transactions are flagged for manual analysis by specialists. In the new system, each transaction is automatically checked by algorithms that can instantly freeze funds without human involvement.

Circle’s Compliance Engine analyzes not only users’ direct transactions, but also their connections to other addresses, transaction history, time and frequency of transfers, and geographic activity patterns. The system automatically flags “suspicious” operations and transmits the information to regulators — before the user even becomes aware of the freeze.

What is especially dangerous is that the criteria for “suspiciousness” are not defined by law, but by internal corporate algorithms. Buying coffee at the “wrong” time, sending funds to the “wrong” country, or even using privacy features too frequently can become grounds for automatic blocking.

Coordinated attack: synchronization of Arc and Tempo

The simultaneous launch of two major blockchains — Arc by Circle and Tempo by Stripe — in August 2025 is no coincidence. It happens at a critical moment when Ethereum is experiencing a yield crisis for token holders due to low transaction fees.

Think of it as military strategy: strike your opponent at the moment of greatest vulnerability. Ethereum is facing a structural problem — low fees mean low income for those supporting the network through staking. Studies show that mass withdrawal from staking is more likely when returns are low, creating a perfect window for alternative blockchains.

The attack mechanism through yield compression

The simultaneous launch of two Ethereum-compatible blockchains creates a significant outflow of liquidity from the Ethereum ecosystem. It’s like suddenly building two new highways in a city with one major road — traffic will redistribute, and the original road becomes less loaded and less profitable for those maintaining it.

Arc and Tempo offer alternative yield narratives — Arc with enterprise-grade stablecoin infrastructure, Tempo with high-performance payment rails — precisely at the moment when Ethereum staking yields are uncompetitive. Liquidity fragmentation potentially worsens yield depression by reducing network activity on Ethereum.

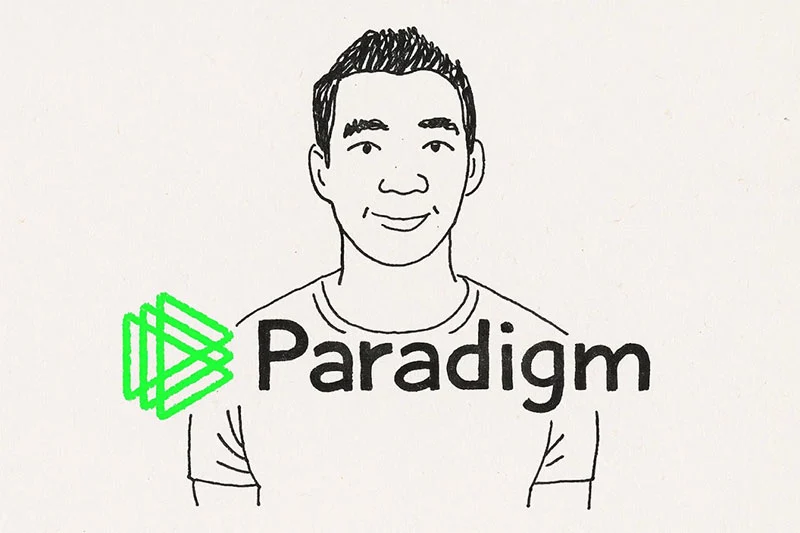

The key point here is coordination between the projects. Matt Huang, co-founder of Paradigm, becomes CEO of Tempo, while Paradigm remains a major investor in Circle. This creates a channel for information exchange between supposedly competing projects and allows for synchronized strategies to maximize market impact.

Matt Huang’s conflict of interest: a systemic threat to fairness

To understand the scale of coordination between the projects, it is necessary to closely examine the unique situation involving Matt Huang, which creates an unprecedented conflict of interest in the venture capital industry.

Imagine a football referee who is simultaneously the coach of one of the teams. He knows his team’s tactics, can make decisions on the field in its favor, and also has the power to penalize opponents. This is exactly the situation that has occurred in the world of venture investments with Huang’s appointment.

Anatomy of a dual role

Matt Huang holds two positions at the same time, and this creates a unique problem for the entire industry.

As a managing partner at Paradigm, Huang manages a venture fund with $12.7 billion in assets. This means he makes decisions about which crypto companies to invest the fund’s money in. He has access to confidential information about the plans of dozens of portfolio companies, their weak spots, strategic roadmaps, and financial condition.

As CEO of the Tempo blockchain at Stripe, he leads a blockchain project at a company valued at $91.5 billion. In this role, he knows all of Stripe’s strategic plans, technical decisions, partnership strategies, and the details of how the company intends to compete in the blockchain payments space.

Many companies in Paradigm’s portfolio compete directly with Stripe. Huang knows the plans of both sides simultaneously and can use this information to make decisions that benefit him personally but are unfair to the market.

Mechanism of information asymmetry

Suppose the company Circle is developing the Arc blockchain, which will compete with the Tempo blockchain from Stripe. Paradigm is considering investing in Circle or its competitors. In a normal situation, the investment decision would be made based on public information about the market, Circle’s team, and its product.

But Huang is in a unique position. As CEO of Tempo, he knows all of Stripe’s plans to counter Circle: which technical solutions Stripe plans to implement, when competing products will be launched, which partners Stripe plans to work with against Circle. This information allows him, as an investor at Paradigm, to make “perfectly accurate” decisions about whether to invest in Circle or choose other players in the market.

This creates an unfair advantage not only for Huang, but for all Paradigm investors who benefit from his insider knowledge. At the same time, it puts all other venture funds that make decisions based on public information at a disadvantage.

Breach of fiduciary duty

A fiduciary duty is a legal obligation to act solely in the interest of the client, even if it contradicts one’s own interests. As a managing partner at Paradigm, Huang has fiduciary obligations to the fund’s investors. He must make investment decisions solely in the interest of the fund and its participants.

But his role as CEO of Tempo creates situations where Stripe’s interests may conflict with Paradigm’s interests. If a Paradigm portfolio company develops a technology that could seriously compete with Stripe, Huang finds himself in a situation where he must simultaneously support this company as an investor at Paradigm and oppose it as a leader at Stripe.

Philosophical shift: from public infrastructure to corporate control

Arc, Tempo, and similar projects represent a fundamental shift from public, universally accessible infrastructure to corporate-controlled, compliance-oriented networks.

Traditional public blockchains function like public roads — anyone can use them, no one controls the traffic centrally, and the rules are the same for all participants. Arc and Tempo are more like private toll highways with checkpoints, where every vehicle is inspected and registered, and traffic rules can be changed at the discretion of the road owner.

Systematic undermining of public blockchains

Arc and Tempo represent a systematic shift in the principles of blockchain technology:

Permissioned validator sets: Arc uses a “limited set of licensed institutions” as validators, which contradicts the principles of decentralization in public blockchains. Instead of allowing any participant to become a validator based on economic incentives, validators are chosen according to political and regulatory criteria.

Compliance-by-design: Both projects integrate regulatory oversight at the architectural level, making censorship and surveillance built-in features rather than external limitations. This fundamentally shifts the balance between privacy and oversight in favor of controlling authorities.

Corporate ecosystem lock-in: The existing client base of Stripe and the spread of USDC from Circle create captive user bases for their respective blockchains, reducing reliance on neutral, public infrastructure.

Geopoliticization of personal finance

Modern practices of crypto exchanges show how corporate decisions turn financial services into tools of geopolitical pressure. OKX blocks accounts of users from Russia and CIS countries, citing “exchange policy” and compliance with sanctions requirements.

But sanctions have traditionally been aimed at specific individuals, organizations, or sectors of the economy. Corporate interpretation of sanctions turns them into a tool of collective punishment of entire nations. A citizen of any country can lose access to their own funds not because of specific actions, but due to geographic origin or nationality.

Arc and Tempo institutionalize this practice by embedding geopolitical censorship into the core architecture of payment systems. View keys make it possible not only to track specific users’ transactions, but also to automatically block operations based on geographic, political, or even ideological criteria.

Tether has already frozen $2.5 billion in user funds. Circle regularly renders USDC tokens “completely and permanently unrecoverable” at its own discretion. In the last four months of 2024, private crypto corporations have frozen more than $100 million of allegedly “criminal” assets — without court rulings, without the right to defense.

Economic consequences: the dollar versus alternative systems

The simultaneous launch of Arc and Tempo represents a strategy of economic warfare against public blockchains and alternative monetary systems.

Treasury weaponization

The use of assets backed by U.S. Treasury bonds as the foundation of new blockchains creates direct government control over decentralized infrastructure. Circle and Tether have already become the largest holders of U.S. government debt among private corporations.

This creates forced financing of government debt: each new USDC token requires the purchase of additional Treasury securities, creating automatic demand for U.S. government debt. The American government gets a guaranteed buyer of its debt, and the Federal Reserve gets a backdoor to influence the cost of maintaining the USDC peg through market operations.

Historical lessons: the collapse of FTX and repeating mistakes

To understand the seriousness of the situation, it is important to recall recent events in the crypto industry. Paradigm lost $278 million in the collapse of the FTX crypto exchange, one of the largest disasters in cryptocurrency history.

The main cause of the FTX collapse was precisely conflicts of interest. The exchange’s founder, Sam Bankman-Fried, simultaneously managed the FTX crypto exchange and the hedge fund Alameda Research. He used FTX customer funds to cover his hedge fund’s losses, which ultimately led to bankruptcy and a prison sentence.

Interestingly, Huang even testified in court against Bankman-Fried, criticizing him for the lack of proper corporate governance and role mixing. Huang stated that Bankman-Fried “did not share Paradigm’s vision of improving the crypto ecosystem” precisely due to ethical issues.

The irony of the situation lies in the fact that now Huang himself is creating a conflict of interest that in many ways is more complex and potentially more harmful than what he criticized Bankman-Fried for. This shows that the lessons of FTX have not been learned even by those who publicly condemned it.

Technical aspects: the blockchain and transparency paradox

The irony of the situation lies in the fact that the blockchain technology Paradigm invests in was created to ensure transparency and eliminate trusted intermediaries. But the actions of Huang and the architecture of Arc/Tempo demonstrate a concentration of power and lack of transparency that blockchain was intended to eliminate.

If Paradigm’s investment decisions were recorded on the blockchain with timestamps and full disclosure of justifications, this could have prevented or at least made visible the use of insider information. But traditional venture capital remains one of the least transparent areas of finance.

Systemic influence on market dynamics

The actions of the participants in this scheme affect not only individual companies, but the entire crypto ecosystem through the distortion of natural market dynamics.

Artificial market signals

When one market participant has unfair access to information, it distorts price formation. Imagine the market as a large auction where prices are formed based on what participants know. If one participant knows significantly more than others, they can place bids that seem irrational to others but are actually based on insider information.

Huang’s decisions as an investor at Paradigm can affect the valuations of dozens of crypto companies. If he knows from his role at Stripe that a certain technology will be successful or fail, he can accordingly increase or decrease Paradigm’s investments in companies working with that technology.

Other investors, seeing Paradigm’s activity, may interpret it as a signal about market prospects and make corresponding decisions. Thus, Huang’s insider information influences the decisions of the entire industry, creating artificial market signals.

Coordination of actions and manipulation

Huang can synchronize the launch of Tempo products and Paradigm portfolio companies in such a way as to minimize mutual competition and maximize market impact. This coordination can also extend to attracting investments, determining the optimal timing for funding rounds, and directing potential Stripe partners to collaborate with Paradigm portfolio companies.

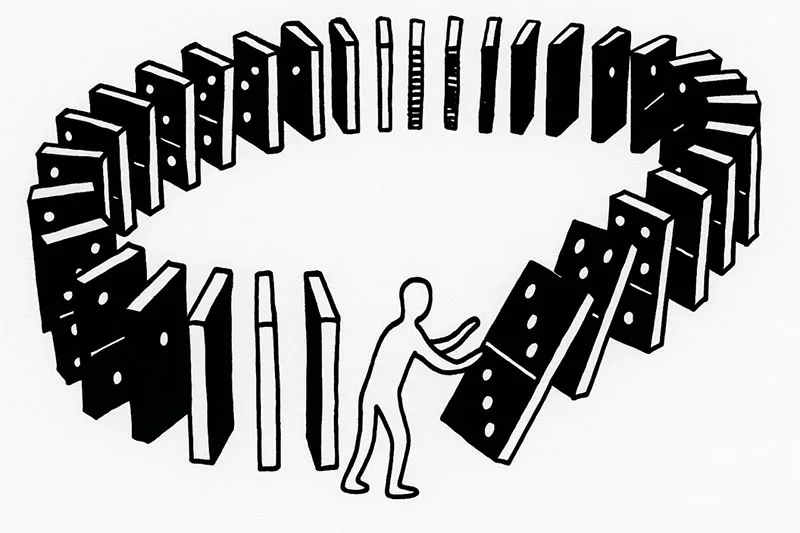

Impact on trust in the industry: the domino effect

Perhaps the most serious long-term consequence of these precedents is their impact on trust in the venture capital industry and the crypto ecosystem as a whole.

Trust is the foundation of venture capitalism — entrepreneurs must trust investors, investors must trust fund managers, and the entire ecosystem must trust that the game is played by fair rules.

If influential industry figures openly ignore conflicts of interest without consequences, it sends a signal that such behavior is acceptable. Other venture partners may begin taking operational roles in companies, the boundaries between investors and managers will blur, and eventually, the entire system may lose its effectiveness.

International perspective: global consequences

The conflicts of interest and corporate control demonstrated by Arc, Tempo, and the situation with Huang are attracting attention not only in the U.S. but also internationally.

Different jurisdictions have different approaches to regulating venture capital and conflicts of interest.

In the European Union, the Markets in Financial Instruments Directive (MiFID) sets strict requirements for disclosure and conflict-of-interest management for financial service providers.

In Asia, especially in Singapore and Hong Kong — where crypto hubs are actively developing — regulators closely monitor the corporate governance practices of international funds.

A poor reputation in the area of conflicts of interest can limit the ability of American crypto companies to operate in these jurisdictions and undermine U.S. efforts to maintain dominance in the global crypto industry.

What this means for the future of money

Projects like Arc and Tempo, conflicts of interest in the venture capital industry, and legislative initiatives like the GENIUS Act represent a turning point in the development of digital money and financial technologies.

Two paths of development

The industry faces a fundamental choice between two models of the future:

The path of corporate control:

Systems like Arc and Tempo become dominant, cryptocurrencies turn into more efficient versions of traditional payment systems — but with even greater capabilities for surveillance and control.

Innovation takes place within corporate ecosystems, but financial autonomy and privacy become a privilege, not a right.

The path of true decentralization:

Preservation and development of public, permissionless blockchains, where innovation happens through open protocols and financial freedom is protected by technical, not legal, guarantees.

The critical role of education and awareness

Most cryptocurrency users do not understand the differences between these models.

They see promises of efficiency, convenience, and regulatory compliance, but do not realize the price they are paying in terms of lost autonomy and privacy.

Educating users about the real differences between truly decentralized systems and corporate-controlled alternatives becomes critically important for preserving the original vision of blockchain technology.

Final thought

Blockchain technology was originally created as a response to the problems of the traditional financial system — excessive control, lack of transparency, systemic risks from centralization. The irony is that today, the most influential players in the crypto industry are recreating those same problems under the guise of solutions.

If we allow this process to unfold without resistance, we will get the worst of both worlds: the technological complexity of blockchains combined with the political control of traditional systems.

The choice between financial freedom and corporate convenience is a choice that every participant in the crypto ecosystem must make consciously.

History will show whether we choose the path of true financial sovereignty — or settle for the gilded cages of corporate efficiency.

The time to decide is now.